Zerodha: The Ultimate Guide to India's Leading Stock Broker

Introduction

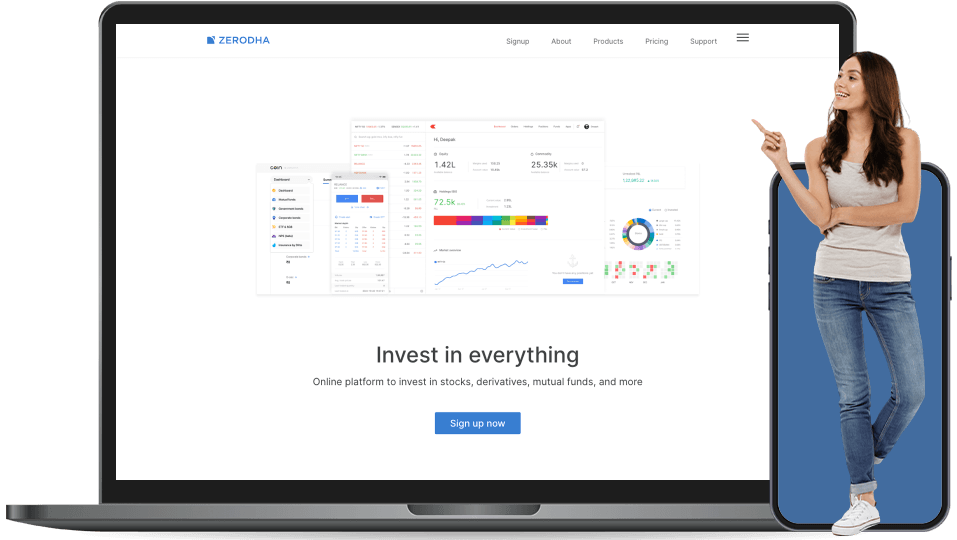

Zerodha is a leading stock brokerage firm in India that has revolutionized the way people invest in the stock market. Founded in 2010 by Nithin Kamath, Zerodha has quickly become the preferred choice for traders and investors due to its low fees, user-friendly platform, and innovative tools and features.

Why Choose Zerodha?

There are several reasons why Zerodha is the top choice for many Indian traders and investors:

- Low fees: Zerodha offers some of the lowest brokerage rates in the industry, making it a cost-effective option for both beginners and experienced traders.

- User-friendly platform: Zerodha's trading platform is easy to use and offers a wide range of features to help you make informed investment decisions.

- Highly rated customer service: Zerodha is known for its excellent customer service, with a dedicated team ready to assist you with any queries or issues.

Key Features of Zerodha

1. Zero Brokerage on Equity Delivery

Zerodha offers zero brokerage on equity delivery trades, which means you can buy and hold stocks without incurring any brokerage charges. This can result in significant cost savings for long-term investors.

2. Flat Fee Trading

Zerodha charges a flat fee of Rs. 20 per trade, regardless of the size of the trade. This makes it easy to calculate your trading costs and ensures that you are not hit with unexpected fees.

3. Advanced Trading Tools

Zerodha offers a range of advanced trading tools and features, including charting tools, technical analysis, and real-time market data. These tools can help you make more informed trading decisions and enhance your overall trading experience.

Pros and Cons of Zerodha

Pros:

- Low fees

- User-friendly platform

- Advanced trading tools

Cons:

- Customer service can be slow during peak trading hours

- Limited research and analysis tools compared to some other brokers

FAQs

1. Is Zerodha safe to use?

Yes, Zerodha is a registered broker with the Securities and Exchange Board of India (SEBI) and follows strict regulatory guidelines to ensure the security of its clients' funds and data.

2. How can I open an account with Zerodha?

You can open an account with Zerodha by visiting their website and following the instructions to complete the account opening process online.

3. Does Zerodha offer intraday trading?

Yes, Zerodha offers intraday trading facilities, allowing you to buy and sell stocks on the same trading day to take advantage of short-term price movements.

4. What is the minimum investment required to open an account with Zerodha?

Zerodha does not have a minimum investment requirement to open an account, making it accessible to investors of all budget sizes.

5. Can I trade in derivatives through Zerodha?

Yes, Zerodha offers trading facilities in derivatives, including futures and options, to provide you with a range of investment options.

Conclusion

Zerodha is a top choice for Indian traders and investors looking for a cost-effective, user-friendly platform with advanced trading tools and features. Whether you are a beginner or an experienced trader, Zerodha has something to offer for everyone. Consider opening an account with Zerodha today and start your journey to financial success.